Bank Of Canada Prime Rate Increase

As long as the current recession continues these rates are likely to stay quite low. Effective Thursday the prime rate at the five banks will rise to 295 per cent from 27 per cent matching the 025 percentage point increase to the Bank of Canadas overnight rate.

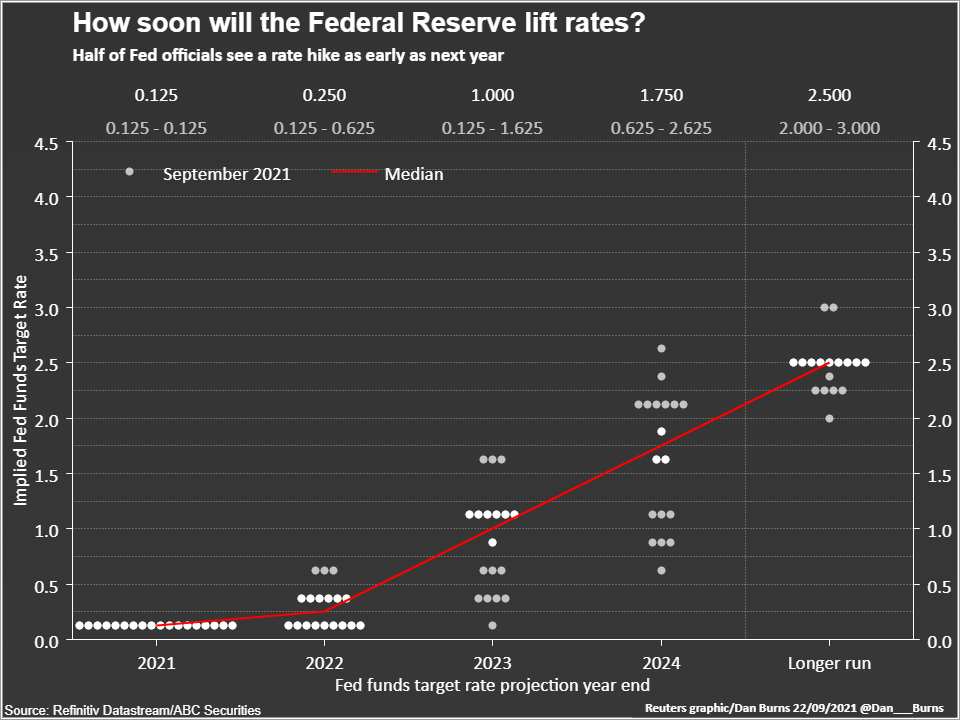

Fed Policymakers See Upward March In Interest Rates Starting Next Year Reuters

Subsequently the key policy rate has significant influence on variable mortgage rates that are based on a lenders Prime rate.

Bank of canada prime rate increase. Conversely when the BoC lowers the overnight rate banks usually lower their. 60 chance of one hike in next 12 months BoCs Headline Quote. How do changes to Prime Rate impact my mortgage payments.

The Bank of Canada is the nations central bank. We are not a commercial bank and do not offer banking services to the public. This has a knock-on effect on mortgage rates which have risen roughly half a percent.

Based on the Banks latest projection policy rate increases are now expected to happen sometime in the second half of 2022 BoC on the Economy. The increase was predicted by many. These include the prime rate which is used by the banks as a basis for pricing variable-rate mortgages.

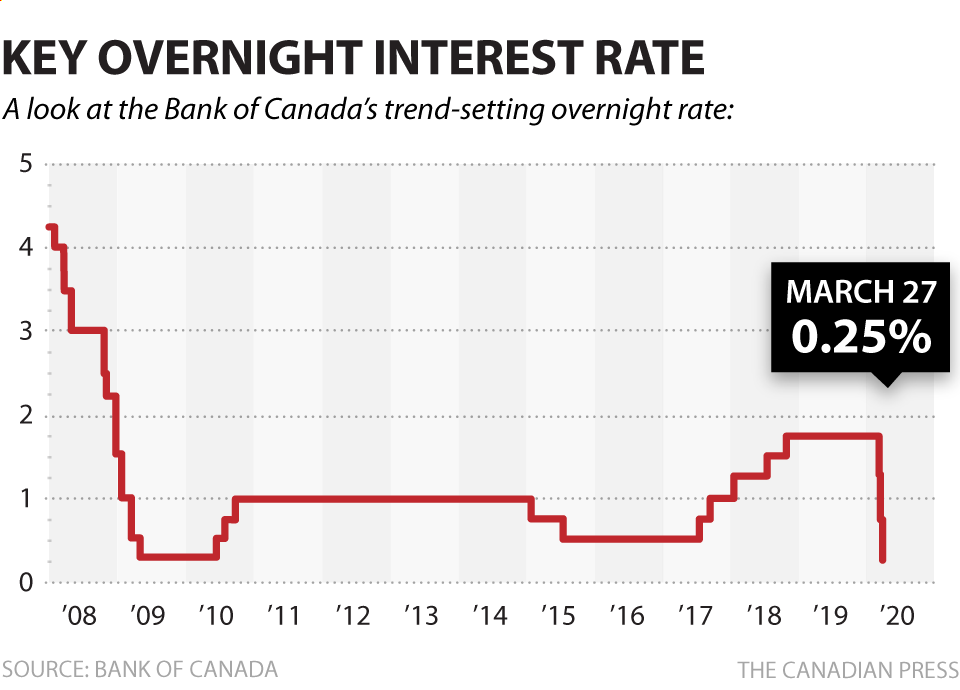

This list indicates that as of August 2012 all of the major banks in Canada have had a prime rate of 3 percent since September 2010. The prime interest rate fell from its previous level of 395 as the bank of Canada accelerated cuts to its overnight rate in order to boost the economy and minimize the financial impact of the pandemic. For example changes in the key policy rate usually lead to changes in bank Prime rates.

MCAP Prime Rate. 2015 Since the Bank of Canada started inflation targeting in 1991 the average Bank of Canada rate hike cycle has lasted 229 percentage points as measured from the trough to the peak as of September 2018. Every economist 100 believes the Bank of Canada will hold the rate on September 8.

The Bank of Canada is once again holding the overnight lending rate at 025. For more information on the policy interest rate see this explainer. 2009 Longest period of no change.

The Bank of Canada delivered welcome news for variable-rate mortgage holders today when it stood by its expectation of no rate hikes until early 2023. The Bank Rate is correspondingly 2 and the deposit rate is 15. Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada.

This means we can expect no changes to the retail prime rate which still sits at 245 260 TD. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada. Housing forecasted to increase at a national average of 2 in 6 months time.

Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management. The Bank of Canada says it has no plans to change its benchmark interest rate until inflation gets back to two per cent and stays there something it says isnt likely to happen until 2023. You can also see the impact to your payments by logging on to MyMCAP and viewing your mortgage details.

That represents an increase of 025 percent from the former average 275 percent prime lending rate in August 2010. When the MCAP Prime rate changes you will receive a letter indicating the new prime rate and its effective date. In response investors demanded higher interest rates to offset those effects.

Earlier this month National Bank of Canada raised its posted five-year fixed rate to 534 per cent while the Bank of Montreal upped the benchmark rate slightly to 519 per cent. The Prime rate has a very close relationship with the Bank of Canada target overnight rate. Effective April 2 2020 MCAP Prime Rate is 245.

Policy Interest Rate. On October 24 2018 the Bank of Canada BOC overnight rate increased to 175. No change to rates Overnight rate.

The prime rate has remained at 245 since it was cut three times in a row in early 2020 when the pandemic first hit Canada. Canadian GDP contracted about 1 in the second quarter of 2021. See Prime Rate Market Rate Forecast.

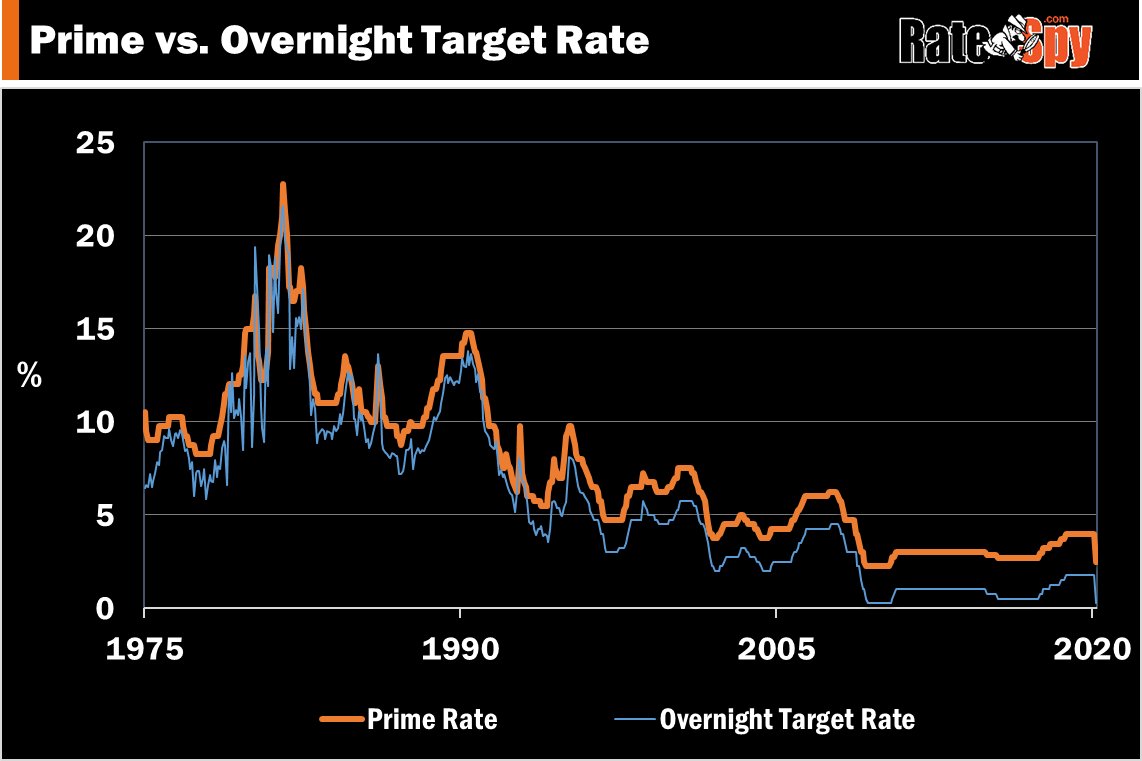

The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products. The prime rate is primarily influenced by the policy interest rate set by the Bank of Canada BoC also known as the BoCs target for the overnight rate. The Bank carries out monetary policy by influencing short-term interest rates.

We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved reads the BoC statement released following its rate. The Bank of Canada interest rate has officially increased for the third time this year. Prospective homebuyers were reassured today that interest rates will remain near historic lows for a long time according to Bank of Canada Governor Tiff Macklem.

At its May announcement the Bank of Canada BoC signalled it might start raising short-term interest rates in late 2022 as a. Long-term government bond rates have risen from 03 to 10 since January. The BoC chief made the comments during a conference call following the Banks interest rate meeting where it left the overnight lending rate unchanged at 025 at its effective lower bound.

Since the late 1990s the Prime rate has stayed within a 50 basis point range around 200 basis points 2 percentage points above the Bank of Canada rate. The Bank of Canada today published its 2021 schedule for policy interest rate announcements and the release of the quarterly Monetary Policy Report. Canadian Interest Rate Forecast to 2023.

In the past high and variable inflation eroded the value of money. In the US the WSJs Prime rate index has stayed exactly 300 basis points above the Federal Reserves Fed Funds Rate for the past two decades. By PurView October 24 2018 No Comments.

Latest Bank of Canada Interest Rate Increase Brings Prime Rate to 175. If you have a variable rate mortgage a. It also reconfirmed the scheduled interest rate announcement dates for the remainder of this year.

A policy-rate change can also affect long-term interest rates especially if people expect that change to be long-lasting. Most economists 93 believe inflation should be allowed to run further to stimulate the economy. Through the key policy rate and its other monetary policy tools the Bank of Canada influences the interest rate for all borrowing and lending transactions in Canada.

Majority of economists 87 believe the rate will hold until second half 2022. Key points from the Bank of Canada September 2021 announcement. It does this by adjusting the target for the overnight rate on eight fixed dates each year.

Growth in the first. The Bank of Canada opted to keep its benchmark interest rate steady at a record-low 025 per cent Wednesday saying the pandemic recovery continues to. When the BoC raises the overnight rate it becomes more expensive for banks to borrow money and they raise their respective prime rates to cover the added costs.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TFQIV2ZCEZPADFMMORY4C2XMVU.png)

Fed Policymakers See Upward March In Interest Rates Starting Next Year Reuters

City Owned House Now Vacant For 2 Years As Vancouver Implements Empty Homes Tax Cbc News Vacant Abandoned Mansions Lake House

Process Mapping And Improvement Kaizen Process Map Kaizen Pmbok

Are You Getting A New Mortgage Or Renewal Some Mortgage Brokers Are Saying It May Be Time To Lock Into A Fixed Rat Viral Post Mortgage Brokers Mortgage Payoff

Boulder Radon Mitigation Boulder Real Estate News Radon Mitigation Boulder Real Estate Mortgage Blogs

Rising Rates What Would The Mortgagegirl Do Mortgage Blogs Mortgage Lenders Paying Off Mortgage Faster

Re Max Canada Best Agents Remax Real Estate Website Real

U S Construction Spending Posts Biggest Increase In Nine Months Nine Months Economic Indicator Months

Prime Rate In Canada 2021 How To Save Money

The Best Cheapest Cellphone Plans In Canada In 2019 How To Plan Mobile Virtual Network Operator Cell Phone Comparison

What Is Fixed Variable Mortgage Mortgage Loans Pre Qualify Mortgage Payment

Which Countries Use The Most Electricity Https Www Statista Com Chart 19909 Electricity Consumption Worldwi Electricity Consumption Electricity Infographic

The Sixth Edition Of The World Ultra Wealth Report Analyzes The State Of The World S Ultra Wealthy Population According To Wealth Inequality Growth Hong Kong

Bank Of Canada Slashes Key Interest Rate To 0 25 National Globalnews Ca

Canadian Real Estate Numbers Soar As Bc Sales Surge Kind Of Better Dwelling In 2020 Vancouver Real Estate Real Estate Buyers Real Estate

Bank Of Canada Holds Key Interest Rate But The Cost Of Your Mortgage Financial Post

Success Story Of Netflix Services Netflix Netflix International Success Stories

Difference Between Informative Funny Quotes Mathematics

Calgary Market Insider August 2018 Real Estate Calgary Skyscraper